When the time comes for students to move on from high school and onto college, it is good to have a plan on how to manage such expenses when it comes to living alone and paying for dorms, food, classes and more. It might even come in handy trying to find useful techniques to collect money.

Apply for scholarships

When it comes to saving money, it is said the most popular option is to apply for scholarships. Hundreds of companies and different colleges offer scholarships that have a high percentage of getting accepted for it, according to experian.com.

When searching for scholarships, it allows for a little bit of ease when it comes to worrying about tuition costs. Some colleges offer covering textbooks, food and housing, according to ramseysolutions.com.

“Students need to start their scholarship search as soon as possible,” finance teacher Jennifer Cook said. “Scholarships are not based on athletics and academics and many go unclaimed every year.”

Get a job

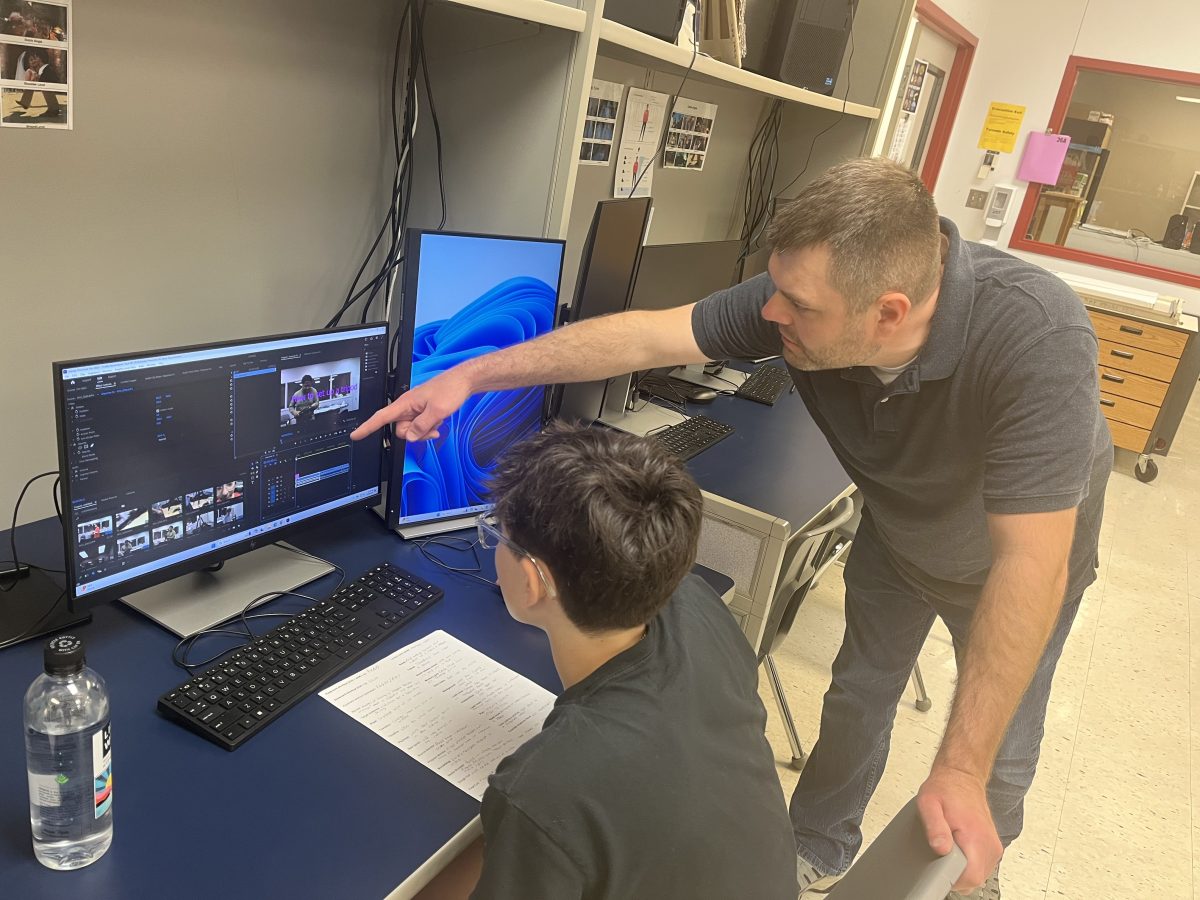

Some decide to get a part-time job to help pay for basic expenses or a full-time job. Doing this can help save money and even gain work experience to put on a resume, according to ramseysolutions.com.

Every extra dollar you earn is one that will not have to be borrowed from a school and is worth more than most people realize, according to salliemae.com.

Open a savings or checking account

Many online banks offer free checking or saving accounts to students to help them stay on track with money spending. Online accounts are often better because it is usually free of fees and you may even receive perks just by setting up an account. One can even look up different bank organizations that are student-friendly and highly recommended or purchase a credit card and set up a budget within the card, which can be beneficial and will help with purchasing major items in the future, according to students.f1busa.com.

When it comes to money, it can be really hard to fight the urge not to spend it on lousy or unnecessary items such as candy, stuffed animals or other things that students tend to forget about after a couple of days. It is why some banks allow you to lock your account to not be able to see the amount of money so that you can save more, according to students.1fbusa.com.

“Save as much as you can before leaving for college,” Cook said. “It will definitely help out in the long run.”